Headline: “Trump’s New Tariffs: A Death Blow to Struggling African Economies?”

By: Dr. Columba Michael Joe Blango

Yesterday, former U.S. President Donald Trump made a stunning announcement imposing massive tariff s on multiple countries, sending shockwaves through the global economy. While developed nations are scrambling to reassess their trade strategies, the real victims could be Africa’s struggling economies—many of which are still trying to recover from years of economic hardship, debt, and poverty.

s on multiple countries, sending shockwaves through the global economy. While developed nations are scrambling to reassess their trade strategies, the real victims could be Africa’s struggling economies—many of which are still trying to recover from years of economic hardship, debt, and poverty.

The phrase “when Donald Trump sneezes, the world catches the flu” might never have been more relevant. If these tariffs significantly affect trade with Africa, economies that are already fragile could face devastating consequences.

How Will Trump’s Tariffs Affect African Economies?

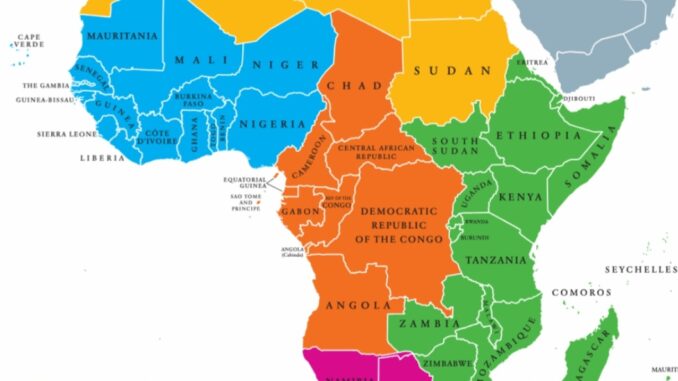

African nations rely heavily on exports, particularly raw materials, agricultural goods, and minerals, to sustain their economies. Many of these products find their way to U.S. markets, and increased tariffs could price them out of competition, leading to job losses, reduced foreign investment, and economic instability.

1. Oil Exporters at Risk – Nigeria and Angola

• Nigeria and Angola are Africa’s largest oil producers, with a significant portion of their exports heading to global markets, including the U.S. If Trump’s tariffs target oil imports, it could lead to reduced demand, falling oil prices, and a sharp decline in national revenue. This would be disastrous for Nigeria, which is already grappling with high unemployment and a weakening currency.

2. Textile and Apparel Industry – Ethiopia and Kenya

• Ethiopia and Kenya have developed thriving textile industries, benefiting from the African Growth and Opportunity Act (AGOA), which provides duty-free access to the U.S. market. If Trump’s tariffs disrupt AGOA or impose new duties, thousands of jobs in these countries could be at risk, and factories that depend on U.S. buyers might shut down.

3. Agricultural Exports – Ghana and Côte d’Ivoire

• Ghana and Côte d’Ivoire dominate global cocoa exports, with the U.S. as a key buyer. If tariffs increase the cost of importing cocoa and processed chocolate from Africa, farmers could see lower demand, forcing them into deeper poverty. Given that over 60% of Côte d’Ivoire’s export revenue comes from cocoa, this could trigger economic instability.

4. Mining Industry – Democratic Republic of Congo (DRC) and Zambia

• The DRC and Zambia are major exporters of cobalt and copper—essential minerals for global industries, including the electric vehicle market. If Trump’s tariffs affect these commodities, reduced exports could stall these countries’ fragile economic growth and worsen unemployment.

What Can African Nations Do?

1. Diversify Trade Partners

• Instead of relying heavily on U.S. trade, African nations should strengthen trade relations with China, the European Union, and intra-African trade under the African Continental Free Trade Agreement (AfCFTA).

2. Invest in Local Manufacturing and Value Addition

• Many African nations export raw materials instead of processed goods. Investing in local manufacturing—such as refining crude oil instead of exporting it raw—would create jobs and make economies more resilient.

3. Strengthen Regional Trade Agreements

• African countries should prioritize regional economic partnerships to reduce dependency on the U.S. market. The AfCFTA, if fully implemented, could provide a much-needed buffer against global trade shocks.

4. Boost Agricultural Self-Sufficiency

• Governments must support small-scale farmers with subsidies and better infrastructure to make African agriculture more competitive and less dependent on exports.

5. Engage in Diplomatic Negotiations

• African leaders should engage directly with U.S. policymakers to negotiate exemptions or reduced tariff impacts, similar to how some Asian and European nations handle U.S. trade policies.

While Trump’s tariffs might be designed to boost the American economy, they could inadvertently cripple struggling African economies. Nations that have yet to recover from past economic crises may now face new waves of poverty, unemployment, and debt.

So, does Donald Trump’s economic sneeze give Africa the flu? If these tariffs take full effect, the answer is a resounding yes. The challenge for African nations now is to act swiftly—diversifying trade, strengthening regional economies, and reducing dependency on a single global power to secure their financial future.

————

READ OPINION FROM LIBERIA

Liberia 🇱🇷

Sen. Amara Konneh writes on his Facebook handle ✍️👇…

Weekend Reader

The Potential Impact of President Trump’s Tariff on Liberia

On April 2, 2025, US President Donald Trump announced “Liberation Day” and introduced reciprocal tariffs, marking a significant shift towards protectionism in the US’s global economic relationships. In the pre-Trump era, the US strongly supported free-market economies and contributed to the creation of the World Trade Organization (WTO). But the tariffs on imports from developing economies like Liberia are neither reciprocal nor strategically sound, and here is why.

The newly implemented tariffs do not reflect the tariff structures of lower-income countries such as Liberia on US exports, nor do they consider the distinct economic conditions and fiscal circumstances that influence tariff policies in developing nations. Additionally, these tariffs may overlook important factors such as institutional capacity, resource availability, and geographical considerations. Coupled with reductions in US development assistance, these tariffs could pose challenges to the United States’ relationship and reputation in the developing world.

This new US approach presents an opportunity for Liberia to redefine its so-called “traditional” relationship with the US and adapt to the changing global trade landscape.

*Modest Trade with the US*

According to the United States Trade Representative’s 2024 report, our current exports to the US amounted to $72.5 million and were mainly driven by rubber. This represents a 25.5% or $14.7 million increase last year compared to 2023.

A decrease in our rubber production – to 64,516 metric tons in 2023, down from 87,777 metric tons in 2021 – hindered further growth. A WTO report attributed this decline to reduced harvests from small and large rubber and palm oil producers.

According to projections, the tariff increase will impact a modest share of Liberia’s Gross Domestic Product (GDP), which stood at $4.24 billion in 2024.

Nonetheless, the volume is significant, as seen below:

* – Rubber: $63.5 million

* – Diamonds: $935,000

* – Palm Oil: $866,000

*Tariff Increase on Current Exports*

The US has classified Liberia in the lowest base tier and applied a 10% tariff rate to our exports – a big jump from the simple average of 3.3% in place before the “Liberation Day” announcement. President Trump’s Executive Order stipulates that the new 10% rate will apply to all goods entering the United States under the existing trade agreements, including the African Growth and Opportunity Act (AGOA), which facilitates preferential access to the U.S. market for various products.

AGOA covers agricultural goods, minerals, and select manufactured items such as rubber and apparel. Liberia enjoys significant advantages under that agreement, including duty-free access for nearly 7,000 tariff lines. Under AGOA, all tariff lines related to our rubber, diamonds, and palm oil either faced significantly lower tariffs or had their rates eliminated.

This AGOA regime underscores the US and African countries’ shared commitment to fostering cooperative and mutually beneficial trade relations. Given the prohibitive tariffs imposed on Lesotho and other major economies across the continent – up to 50 percent! – it remains to be seen whether AGOA will last in any form.

Suppose President Trump decides to upend these trade agreements altogether. In that case, a 10% tariff will not only increase prices but also shift trade patterns as buyers engage countries and regions offering similar products. Liberia produces in more favorable business environments with less rent-seeking and corruption. Even then, it remains within our power to make Liberia a more attractive business climate.

*Ripple Effects in Europe?*

While President Trump’s decision may have limited immediate effects, implementing the 10% US tariff on Liberian goods could trigger significant ripple effects if the protectionist bug spreads across the Atlantic to Europe, by far our largest trading partner.

According to the Central Bank of Liberia, our main export partners are Switzerland ($708M), the United Kingdom ($306M), France ($197M), Germany ($155M), and Lebanon ($105M). The slightest increase in tariffs by any of these countries could shake Liberia’s economy to the core.

*Ripple Effects at Home*

The Trump administration views tariffs as a way to boost government revenue, encourage the reshoring of US industries, and balance bilateral trade imbalances. This is fair enough. While these objectives may have merit, imposing high tariffs on developing economies—especially those without competing domestic industries, like rubber and palm oil—can create challenges for these nations, which already face reduced US development assistance. This approach does not align with the principles of reciprocity.

The tariffs follow his cuts to USAID-funded projects, significantly affecting Liberia’s essential sectors such as Health, Education, and Agriculture. This situation has heightened the fiscal pressures the Government of Liberia (GoL) faces, which now needs to allocate resources to programs once funded by USAID.

In response, the government has raised the goods and services tax (GST) from 10% to 12%, reintroduced a $0.20 surge charge on each gallon of petroleum products, and added a $0.05 per gallon charge for storage. In a joint press release, the Liberia Petroleum Refining Company (LPRC), the Ministry of Commerce and Industry (MoCI), the Ministry of Finance and Development Planning (MFDP), and the Liberia Revenue Authority (LRA) said these measures aim to bolster revenue generation in light of the reduction in official development assistance.

While these interventions are understandable, it’s important to consider their potential impact on citizens. Increased taxes on petroleum, goods, and services will raise prices, further straining households already facing economic difficulties in a low-growth and high-joblessness environment.

President Boakai and his economic team must now inform the Liberian people of the potential implications of President Trump’s proposed 10% tariff on Liberia’s economy and outline strategies to mitigate any adverse effects on related revenue streams currently facing challenges. Furthermore, it has become all the more important that we accelerate negotiations with our major concessionaires – especially Arcelor Mittal and Ivanhoe International (HPX) – and immediately launch a review of the outrageous fiscal incentives we granted to other concessionaires, especially, Bea Mountain Mining Corporation, to maximize the benefit of our national assets to the people. They are our partners in development as much as we are theirs in profit, and I look forward to their cooperation in ensuring our stability. Advancing these ideas will be the focus of our engagement with colleagues during the Senate’s next sitting after recess.

I remain optimistic about future collaboration with our government and its trading partners as we navigate these economic complexities together. As a former Finance Minister, I understand there are no simple solutions to our current challenges. Nevertheless, we must pursue effective and growth-oriented strategies that prioritize the welfare of our citizens.

Fiscal prudence should be our primary goal rather than merely raising taxes.

Full list of African countries hit with Trump’s tariffs: https://businessday.ng/business-economy/article/updated-full-list-of-african-countries-hit-with-trumps-tariffs/

Keep following Legit News Africa

We’re Authentic and Reliable!

Leave a Reply