*Basita Michael*

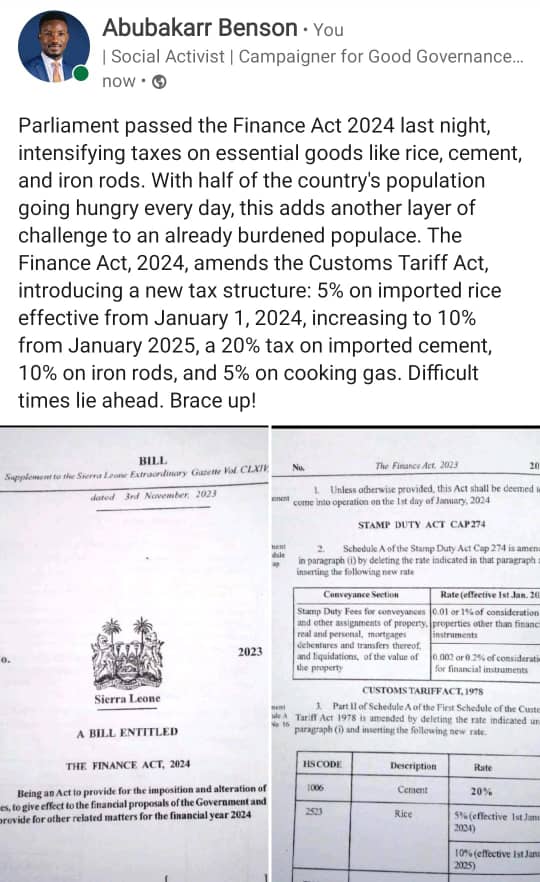

The recent approval of the Finance Bill 2024 has triggered widespread discontent among Sierra Leoneans, primarily due to the imposition of several new taxes, notably a 5% import duty on rice. Sierra Leone, being a food-deficit country, relies heavily on rice as a staple food for most citizens. The imposition of a 5% import duty on rice is anticipated to escalate its price, potentially rendering it unaffordable for many Sierra Leoneans and, consequently, posing a significant threat to food security in the country.

This development has revived a prevailing sentiment that Parliamentarians are falling short in defending the interests of the people with the expected diligence. Of particular concern is the swift passage of the Bill through all the legislative stages in a single day, prompting questions about the thoroughness with which our Parliamentarians examined the practicality and impact of these taxes on economic growth and the financial well-being of citizens. This rapid approval raises doubts about the efficacy of these taxes in delivering on the budget’s promise of “restoring macroeconomic stability while protecting the poor and vulnerable.” The accelerated process also limited opportunities for public engagement, feedback, and meaningful consultations with constituents, thus undermining transparency and accountability in the legislative process.

Acknowledging the necessity of taxation for a country’s sustenance, it is imperative that such taxes be just and fair, taking into account the economic landscape and the earning capacity of citizens. Currently, people are struggling to meet their basic needs, and these tax hikes are poised to further increase the costs of already expensive goods, creating an unfavorable perception of a tax regime that is punitive. The imposition of new taxes can potentially dampen economic activity and may discourage investment and impede economic growth.

The existing tax system in Sierra Leone is regressive, placing a disproportionate burden on the poor. A more equitable and progressive tax system would ensure that everyone pays their fair share of taxes while safeguarding the most vulnerable members of society.

The reality is that the small fraction of citizens fortunate enough to have employment are already grappling with the escalating cost of living, with many not having experienced a substantial salary increase for a long, long time. The plight of ordinary jobless citizens is even more dire. As the Bill awaits the President’s assent, it is hoped that His Excellency will attentively listen to the concerns of Sierra Leoneans.

*What Happen in Parliament on the Finance Act 2024 debate*

– The APC MPs gallantly stood by the people through out the debate right on to the committee stage with very convincing arguments.

– The APC MPs moved a motion for the suspension of the implementation of the proposed 5% import duty on Rice , 10% on Cement and 20% on Iron rod but lost the vote .

– The APC MPs moved and succeeded in achieving a reduction of the proposed 15% on Withholding Tax on Rent to 10%.

– The APC MPs moved and succeeded in reducing the proposed 15% withholding Tax on Lottery/betting winnings to 10%.

– The APC MPs secured in securing our local industries like Brewery Ltd which the Bill was going to kill by ensuring an Excise Tax reduction of 50% from what beverage importers are being levied .

– The APC moved to stop the *FLOOR PRICE* of 15% on Billable and unbillabe call/data Promotions but LOST the vote .

-The APC MPs moved and succeeded in reducing the proposed 100% increase on Farm Land annual levy by 50%.

@*Parliamentary Spokesperson*

SLPP RUNS OUT OF CASH AND IMPOSES TAX ON THE NATION’S STAPLE FOOD

Dr. Doma: Sierra Leone Telegraph: 11 November 2023:

The government of Sierra Leone has run out of cash and the stomachs of every Sierra Leonean is about to feel the pinch, as the country’s economy continues to falter.

The government’s proposed Finance Bill 2024 reads like a recipe for financial turbulence, with huge taxes on rice, petroleum products, cement, and iron rods on the horizon.

The economy it seems is being steered into stormy waters by those who should be guiding it safely towards the ‘New Direction,’ prosperity, and the much-talked-about Feed Salone agenda.

Rice, the staple food of the entire nation is for the first time in the country’s history, now under the taxing gaze of the government to raise much needed revenue for spending on essential public services.

In a country where more than half the population struggle to put food on the table, this move seems as sensible as dancing in a thunderstorm.

Chief Minister Dr. David Sengeh might soon advise us to savour each grain of rice we eat, as he recently suggested on his Facebook page for citizens to use their mobile data wisely.

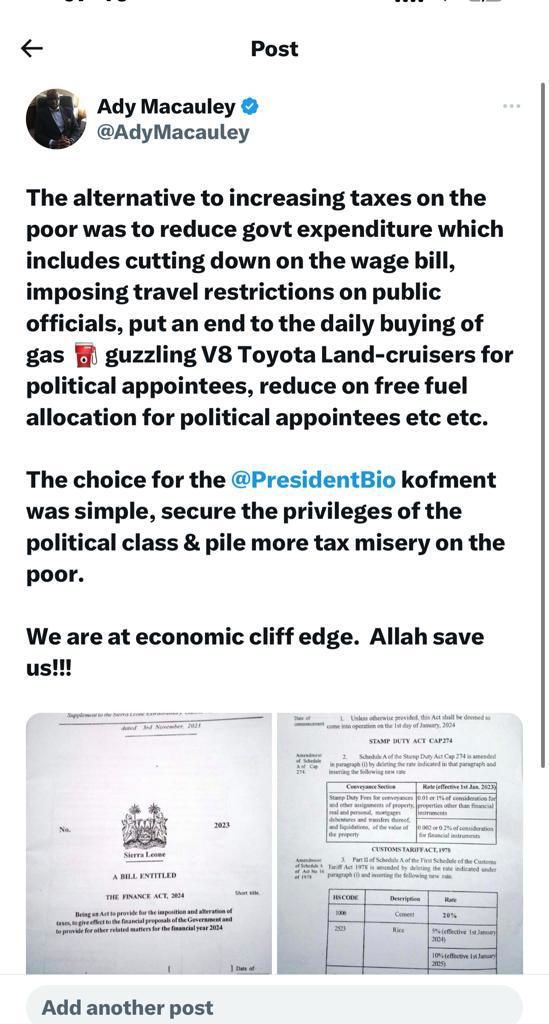

The Finance Bill 2024 paints a vivid picture of tough choices ahead for an already impoverished citizen, instead of the government cutting back on its extravagant spending on overseas travel, spending on luxurious V8 Toyota Land-cruisers, free fuel allocations for public officials, and unnecessary political appointments that have caused a bloated public sector wage bill.

In this financial storm that will soon hit Sierra Leone, President Bio is at a crossroads: protect the privileges of the political elite or alleviate the tax misery on the poor.

Sadly, President Bio has chosen to tax the stomachs of those who can least afford it. Poverty stricken Sierra Leone is now teetering on an economic cliff edge, as the people pray for salvation from above.

The 2024 Finance Bill unveils a tale of government indifference, where tax hikes rain down indiscriminately on a population that is already grappling with daily economic and social challenges.

As the President looks up to the people to bail the government from the financial mess it created for itself after five years in power, many in Sierra Leone are instead looking to the President to plug the financial loopholes – as promised in 2018, reduce per diem, and combat corruption, instead of squeezing the stomachs of the poor.

Sierra Leoneans, left to weather this fiscal storm, are in dire need of a silver lining.

Perhaps in the humour of hardship, we can find solidarity in collectively navigating these choppy economic waters. God/Allah save us all as we strive to make sense of a Finance Bill that seems to tax our patience as much as our stomachs.

All this, in the context of poor monetary policy, with no credible plan to take the old Leone out of circulation and reverse its depreciation against other currencies, combined with very high interest rates for businesses, which is deepening the economic crisis the government now finds itself.