By Chernoh Alpha M. Bah, Matthew Anderson, and Mark Feldman

An internal fraud investigation instituted by the management of Sierra Leone’s National Revenue Authority (NRA) on the collection of Foreign Travel Tax (FTT) has revealed a pattern of missing tax revenues and failure to collect billions of Leones in outstanding taxes from foreign airlines operating in the country. In fiscal year 2019 alone, investigators say revenues totaling Le3.2 billion in foreign travel taxes were not paid into the relevant bank account at the Bank of Sierra Leone.

“Based on the fraud investigation carried out by the management of the National Revenue Authority (NRA), we observed that staff were issuing receipts to airlines or agents of airlines for revenues that were not in the bank statement,” a report on the investigation states. Authorities also discovered that some airlines and their agents were paying FTT into commercial banks rather than the designated FTT account at the Bank of Sierra Leone.“As a result, for 2019, a total of Le3,208,245,094.20 purported to have been paid into the Zenith Bank and Standard Chartered Bank was not in the bank statements,” they noted.

Details of the investigation, which the Africanist Press has seen, also states that penalties totaling Le3.6 billion were levied on defaulting taxpayers but no evidence was submitted to ascertain that the NRA took further actions to collect these funds. “From the review of taxpayer’s files in respect of FTT, we observed that penalties totaling Le3,601,203,494 were levied on taxpayers who failed to make payments on their tax liabilities on or before the 15th of the following month. Even though letters were written to taxpayers or their agents for 2018 and 2019, no evidence of payment or responses were sited in their respective files,” they said.

Authorities also report that revenue totaling Le13.6 billion was found in the bank accounts at the Bank of Sierra Leone for which no supporting documents were submitted to allow for a verification of the completeness and accuracy of the amount in the bank accounts. “Revenue totaling Le13,842,773,928.66 was seen in the accounts of the Bank of Sierra Leone for which no supporting documentation was submitted to ascertain the accuracy of the amount in the account,” they said, adding that during the fiscal year 2019, the Sierra Leone Civil Aviation Authority (SLCAA) also collected and issued receipts to Air Peace and Royal Air Maroc that could not be traced.

“We observed that tax revenue totaling Le997,803,438 in respect of Air Peace could not be traced to accounts held at the Bank of Sierra Leone,” they said. The SLCAA, they noted, is not authorized to assess and collect taxes in the country. The report also discovered that some of the airlines operating in the country had no tax files on record with the SLCAA.

“A Review of the SLCAA foreign airlines register for the year 2019 and files submitted revealed that some airlines which were in operation had no files,” the report states. Investigators said they were unable to validate whether they these foreign airlines were filing their tax returns and paying foreign travel tax revenue already levied on passengers.

“Some airlines failed to pay their foreign travel tax for some months during the year 2019 as tax returns, NRA/SLCAA receipts and other documents were not seen in the airline files,” the report observed. Authorities conclude that a high risk exists that much needed financial resources of government might have been lost because it was difficult to ascertain whether the airlines in question paid the correct taxes due.

“Lack of documentation from airlines may lead to misinformation and non-payment of tax liability,” they stated.

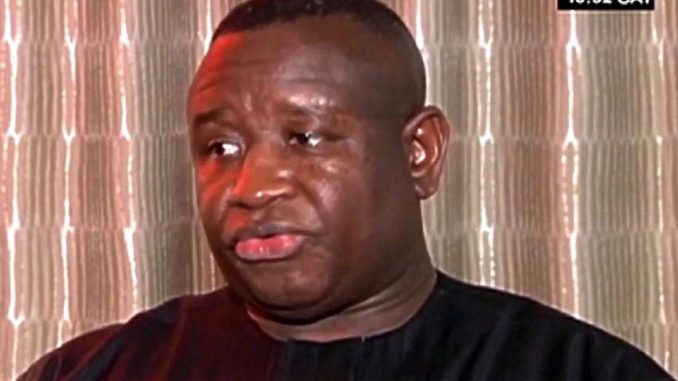

However, Sierra Leone’s aviation authority chief, Moses Tiffa Baio did confirm that a fraud investigation was conducted in 2019 by the NRA and that the Sierra Leone Civil Aviation Authority (SLCAA) collaborated with the NRA in the said investigation. “The investigation was conducted last year but I can’t recall the exact date and month the SLCAA was visited by the auditors. We did collaborate with the NRA on this fraud investigation and many other things that deal with the airlines,” he said, adding that the civil aviation authority’s role “was just to cross check the passenger data on which the fees were levied.”

Baio denies the report’s observation that the SLCAA assessed and collected tax revenues from airlines and their agents in 2019. “SLCAA doesn’t conduct tax assessment neither collect FTT, everything is done by the NRA.

However, we can facilitate the process from either side if the need arises. For example, if an airline wants bank details for FTT to make a transfer, we could provide it for them, and the same could be done to NRA if they want passenger statistics or sales report for a particular airline, we can provide it to them as well,” he says, adding that their role is to facilitate the tax administration process only. “The NRA is the only institution that collects all government revenues including foreign travel tax,” Baio said.

Baio equally says the issue of Air Peace was the result of a mistake in a wire transfer in which a total of Le1.3 billion was “mistakenly lodged into the CAA Operating Account instead of the FTT Account at the Bank of Sierra Leone.” He claimed that the error was corrected as the said funds were reversed from the SLCAA Operating Account and re-lodged into the FTT Account on April 2, 2019. “Air Peace mistakenly transferred Le1.3 billion into the CAA Operating Account instead of the FTT Account. Both accounts are held at the Bank of Sierra Leone but the said transaction was reversed and the money was transferred from the CAA Operating Account into the FTT Account,” he says.

On the payments from Royal Air Maroc, Baio also says the issues had to do with March to August 2019 payments that transferred by Air Maroc into a designated bank account for FTT but the airline had delays in receiving receipts from the NRA for onward submission to their head office in Casablanca. “So, they contacted the SLCAA to provide them with an acknowledgement note for the payment for ease of reporting to their headquarters,” he said, adding, “this the SLCAA didn’t find anything wrong in doing for the simple reason that the said transaction has been verified to be true based on the submission of the swift transfers by the airline.”

He emphasized that the action is in line with their obligations as a regulatory agency. “We also owe the foreign airlines a duty of care in their operations in Sierra Leone, which means that anything that has a potential to disturb their operations has to be a matter of concern to us and particularly when we’ve tried to get the state agency concerned to address the situation but all efforts have proven to be unsuccessful,” he stated. Nevertheless, both the NRA fraud investigation and a recent internal government audit, details of which the Africanist Press has also seen, dismiss the excuse that the Air Peace and Royal Air Maroc transactions were the result of a mistake in wire transfers and delays in the processing of NRA receipts. Details of a government audit report seen by Africanist Press recently noted that the total of Le3,208,245,094.20 purported to have been paid into the Zenith Bank and Standard Chartered Bank was still not in the bank statements.

Authorities have recommended that the Commissioner General of the country’s National Revenue Authority (NRA) should ensure that action is taken to retrieve the stolen revenue from the respective staff. They say satisfactory explanation should also be provided as to why SLCAA is assessing and collecting tax revenue from airlines and their agents. “Supporting documentation must be provided in respect of the Le13.8 billion in the accounts at the BSL within 15 days upon receipt of the report,” they stated, and called for an accounting of the missing Le997.8 million in tax revenue from Air Peace.

Africanist Press could not independently verify whether the recommended actions and supporting documents in respect of the missing funds had been submitted as at the time of publication. Moses Tiffa Baio, however, says he has not received any correspondences from anyone regarding the recommendations. “Like I have said earlier, the NRA is aware about these issues,” he stated. Africanist Press could not get the response from the National Revenue Authority (NRA) despite an email correspondence and phone calls to the Commissioner General regarding the issues raised in the report and the response of the SLCAA.

We have published above samples of relevant bank statement from the SLCAA, copies of FTT Accounts, and excerpts of the investigation report showing details of the outstanding foreign travel tax revenues and foreign airline tax revenues that auditors say are still unaccounted for.