An open letter to the HON. SIR JUSTICE BIOBELE ABRAHAM GEORGEWILL, JCA, DSSRS, KSC

Chairman and Sole Commissioner, Commission No. 64

Hon. Judge,

Hear Me: All is not well with your Report

You recall the ceremony to mark the completion of the work of the three Commissioners of the Commissions of Inquiry (COIs) instituted by the current Government and the handing over of your reports thereto. You were the spokesman for the Commissioners. You were in a very exuberant mood as if to say and assure your employer “Master! I have done a good job as I have nailed them all.” You seemed so eager to name those you had nailed that you breached protocol by actually naming a few. Amongst which were two former Governors of the Bank of Sierra Leone (BSL) who you claimed had been caught in the net. Being a former Governor of BSL, the bit of information caught my attention but I shrugged it off because I had neither been invited by the State (State Counsel) nor the Commission (Commission Secretariat) or the Sole Commissioner (your good self) to your COI on anything.

This calmness and reassurance in me were shattered when the White Paper on the COIs was released. I found out I was docked on two counts and ordered to refund to the State 1). $3m of an advance deposit paid to SMRT for and on behalf of National Civil Registration Secretariat (NCRS) for the supply of Biometric Registration Kits and 2). $12.2m of money used to bailout Rokel Commercial Bank (RCB).

Initially, I was shocked and confused, particularly as the White Paper contained a highly summarized version of your findings laid out in six sentence lines set in the second paragraph of page 22.

However, the details of the findings of your COI on the matter are found in:

“CHAPTER NINE

9. Investigation into the activities of the Petroleum Directorate between November 2007 and April 2018.” contained in Pages 102 to 111 of your Report Vol. 1

As I read chapter 9, I started feeling cheerful. When I got to the first and main paragraph on page 106, particularly the two sentences starting from line 15 which states “…The loan of USD 14,000,000, granted to the Rokel Commercial Bank was for its recapitalization and the Government of Sierra Leone which had 51% share in the Rokel Commercial Bank before the recapitalization now has 65.02% of the shares. The Rokel Commercial Bank is now one of the most successful and profitable Commercial Banks in Sierra Leone….” I was ecstatic.

Hon. Judge, this was you confirming that indeed the said money of US$12.2m which you had ordered, I and my collaborators should refund to the state as punishment for corruption is with RCB. Consequently, Government shareholding in the Bank had increased, the Bank had become profitable and obviously paying dividend to Government which goes to defray the loan. The circle was complete and this was the intended outcome. Why punish me for a job well done?

This is why I consider the melancholy conclusion contained in the immediate paragraph starting at the bottom of page 106 unto page 107 as betrayal of your oath of office. Take a look at it. Why should I refund money which you have identified exists, was used as intended and yielding positive results? Did you examine my period of stewardship in relation to performance and subsequent developments after I resigned from BSL?

At this point, the realization dawned that this matter of the COIs has been in the court of public opinion for the past two years and with so much salacious information and character assassinations, names being destroyed and the humiliation reaching unbearable levels. Accordingly, I decided it was time to join the fray by making public my side of the story of your findings and orders for it also to be out there in the court of Public Opinion. Based on how you have treated the matters I was involved in your Report, I can infer that all is not well with your Report.

My focus is on your Report, Vol.1, as the Government White Paper mirrors your said report.

For the purpose of clarity, let me first summarize the key points on my side as follows:

- I was never availed the opportunity to challenge/confront my accusers when your COI was investigating the activities of Petroleum Directorate (PD) for the period 2007 to 2018.

- As a corollary to the above, you cannot therefore try me, find me guilty, and punish me in absentia on the basis of evidence adduced in your COI particularly as I or my counsel did not participate in the deliberations.

- A key aspect of Governance is continuity. I had resigned and left the BSL on 13th April 2016 and ceased to be Minister, MOFED on 4th April, 2018. You cannot hold me responsible for any obligations entered into in respect of the two transactions which did not seem to immediately yield the planned outcomes.

- For the said two transactions involving the utilization of funds of PD, permission was sought and obtained from His Excellency, the ex-President, of the Republic as the SUPREME EXECUTIVE AUTHORITY (SEA) of the Government.

- I should not be a victim in the on-going mumbling and bungling effort to try and understand, define and determine the meaning of SEA in the Sierra Leone Constitution.

- No losses occurred in the two transactions. You clearly established that the US$12.2m is with RCB and doing wonders. Also, that the US$3m was paid to SMRT as initial deposit for the Biometric Registration Kits which the company supplied and used in the 2017 voter registration for the 2018 Local Council, Legislative and Presidential Elections. Today the kits are with the NCRS and deployed all over the country in pursuit of its work.

I searched for clues as to how you did your work and analysis to arrive at your findings and conclusions which by my reckoning were at variance with the real story of the two transactions. This search focused my attention on your Methodology as contained in pages 5 and 6, of your Report and produced hereunder:

“Methodology

‘In undertaking its assignment this Commission adopted a robust approach to ensure that it carried out its work successfully and in accordance with due process and the rule of law in Sierra Leone. To this end, it was guided by the provisions of the Constitution of Sierra Leone1991 (as amended), the Sierra Leone High Rules 2007 and the Practice Directions made by the Commissioners to ensure the observance of the right to fair hearing to all persons who appeared before the Commission. Proceedings were mostly, except on some occasions, held in public and televised live. It was adversary in nature with the common law historical origins of the laws and practice in Sierra Leone. The State was represented by counsel and the Persons of Interest were also represented by counsel of their own choice. Both parties were given equal treatment to ensure fairness and impartiality. The State presented its witnesses on all the areas of the investigations. The strict rules of admissibility of evidence were relaxed for both the State and the Persons of Interest. The witnesses for the State were subjected to cross examination by counsel to the Persons of Interest. The sacrosanct rules of fair hearing were scrupulously observed and adhered to by the Commission. Both the State and the Persons of Interest were afforded further opportunity to file and present their written final summations of the facts applicable laws. When deemed necessary this Commission paid scheduled visits to projects sites accompanied by both parties and the Press. Some persons though not originally within the Remit were subsequently summoned by this Commission to appear before it, some of whom were later turned into Persons of Interest by this Commission due to evidence of their direct involvement in some of the areas of investigations to avail them the opportunity to respond to evidence led against them. In the Main Report Volume One: Investigations of the MDAs, this Commission had a total of 68 public sittings from Monday, 2nd day of February 2019 to Friday, 13th day of September 2019. A total number of 136 witnesses testified before this Commission, out of which a total number of 126 witnesses testified the State, while a total number of 10 witnesses testified for the Person of Interest. A total number of 1345 documents were tendered in evidence before this Commission, out of which a total number of 1300 documents were tendered by the State, while a total number of 46 documents were tendered by the Persons of Interest. The entire proceeding is captured in the record of proceedings as recorded by the Chairman and Sole Commissioner running into 800 printed pages in Volume Two of the Reports and by the verbatim Recording in Volume Three of the Reports.”

I also considered how the evidence was evaluated as set out in page 107 paragraph 9.4 and produced hereunder:

9.4 Evaluation of Evidence. “This Commission has critically reviewed, appraised and considered the totality of the evidence led by the State against the Persons of Interest and finds that the unchallenged evidence of the State has made out a prima facie case against all of the Persons of Interest. In law, once a prima facie case has been made out, rebuttal evidence from the Persons of Interest is no longer a matter of choice. It is mandatory because without it all the allegations supported by prima facie evidence become duly established by the State, yet on the face of the damning evidence of corruption against the Persons of Interest and their collaborators they had no answer. Indeed, the Petroleum Directorate was one of the most crucial cash – cow for unbridled and mindless corruption by the immediate past Government.”

Hon. Judge, you set out a very elaborate explanation under your Methodology and this is further buttressed by your paragraph 9.4 Evaluation of Evidence. Did you follow and adhere to the procedures as set out in your Methodology? Did you really give me or ensured I or my counsel were given the opportunity to challenge the evidence proffered against me and question the witnesses making the allegations.

The heading of Chapter 9 in your Report states “Investigation into the activities of Petroleum Directorate 2007 and April 2018.” You did not specifically set out to investigate the activities of Momodu L. Kargbo in relation to the PD. My name arose out of the evidence generated by the State from the witnesses presented to your commission. Once my name had been mentioned and you had evaluated that the evidence against me was sufficiently material requiring a rebuttal, it became clear at that point that I was no longer Person of Interest in the general sense of the statutes of the COI. I had become an identified Person of Interest with specific allegations to answer in your COI. Indeed “…In Law once a prima facie case has been made out, rebuttal evidence from the person of interest is no longer a matter of choice. It is mandatory because without it all the allegations supported by prima facie evidence become duly established by the state…” But how was I to know this?

Was it not incumbent on you at this point to satisfy yourself that I had been given the opportunity to make a rebuttal of the prima facie case against me? Didn’t you say in your Methodology that “…Both parties were given equal treatment to ensure fairness and impartiality…”?

Given the exceptionally high stakes involved in the inquiry with the resultant damage to reputation for life, I would definitely have jumped at the opportunity to defend myself “… in the face of the damning evidence of corruption against the Persons of interest and their collaborators….”

Hon. Judge, in your Methodology, you re-assuring of fair and balanced approach. In practice however, you flipped-flopped and became inconsistent to my detriment. You did not always operate by the Methodology you set out in your Report and did not detail the criteria by which you evaluated the evidences provided in your COI against me.

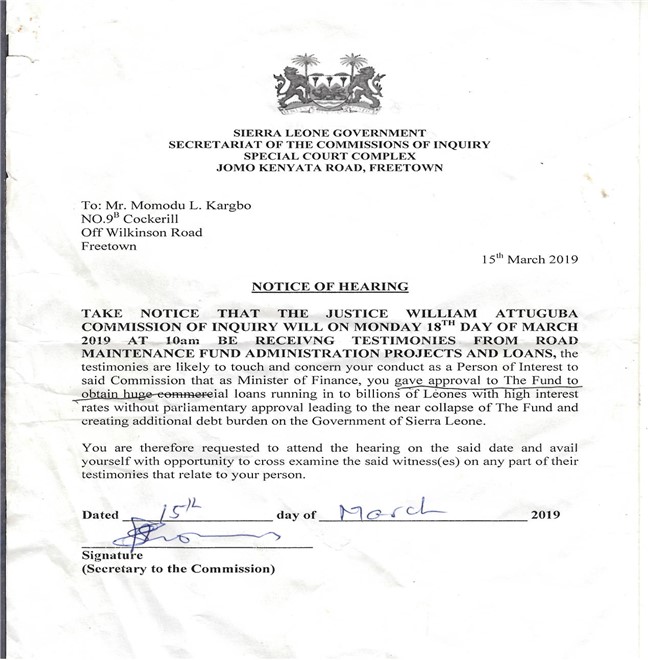

Here is the thing. I was a Person of Interest in the COI of Justice William Annan Ataguba. He investigated the activities of the Road Maintenance Fund Administration (RMFA). An allegation was made against me that as Minister of Finance, I authorized the RFMA to borrow huge amounts of money from RCB, resulting in financial difficulties for the organization, of which I did not have authority to approve. I received a letter with attachments from the Secretary of the Commission and delivered by a policeman at my residence three days before the scheduled date, to attend the hearing “….on the said date and avail yourself with opportunity to cross examine the said witnesses on any part of their testimonies that relate to you.” The said letter is produced above.

Indeed, I did not appear before the commission in person but was represented by Counsel, Mr. Amadu Koroma who demonstrated via the Public Debt Act 2015, of the powers vested in the Minister of Finance to grant such authorization. That nothing has appeared on the final report of the COI on the matter speaks to the outcome.

As sole commissioner of commission 64, the Secretariat of the Commission was under your direct control and supervision. It was your duty and responsibility given the oath you took to be fair and impartial to ensure that the above type letter was issued to me.

Suffice to say that the above approach was not adopted in your COI in my case. The question is why? Was it a set-up? To rope in the Minister of Finance and Economic Development who had also been the Governor, BSL-a prized catch even though you took an oath of office to do justice and treat every person of interest fairly and equitably!

Hon. Judge, it is not enough to say: I want to do justice. I want to be fair and impartial. The litmus test is that you have to be seen, judged and accepted as being fair. There is no evidence in your report that states that I was ordered and /or invited to appear in your COI to challenge/rebut allegation of impropriety made against me. You only made reference to the seven witnesses presented by the state. How was I to know that allegations had been levied against me?

It was for you to satisfy yourself with indisputable evidence that I had been offered the opportunity to challenge the evidences of the seven witness on any part relating to me and failed to do so. At that point, you would have been right to judge me in my absence. Instead, you became an armchair judge and rigour went out of the window.

In respect of your findings and conclusions resulting in punishment being levied on me, page 22 of the White Paper, paragraph 1 starting from line 3 states:

“…Moreover, the former President irregularly approved a loan to SMRT Co. Ltd for the supply of Biometrics Machines amounting to the huge sum of USD3, 000, 000. 00 and the said loan has remained unpaid.

Furthermore, the recapitalization loan of USD14, 000, 000. 00 approved by the former President to Rokel Commercial Bank and given through the National Commission for Privatization was most irregular and the balance of USD12, 263, 821. 00 has remained unpaid since 2015.”

The above summary in the White Paper is made out of your findings and conclusions as set out in page 106, paragraph 1 of your Report as follows:

“On 17/2/2017, on the request of the former Minister for Finance, one Momodu L. Kargbo and approval by the former President, the Petroleum Directorate gave out the sum of USD3, 000, 000. 00 as interest free loan for the supply of Biometrics machines. However, the loan was paid directly to SMRT Co. Ltd, and was to be repaid in equal quarterly installments of USD750, 000.00 commencing from January 2018, which amount had remained unpaid. The Petroleum Directorate had no mandate to give loans. Earlier, on 9/10/2014, on the request of the National Commission for Privatization and approval by the former President, a bridging loan amounting to USD14, 000, 000, 000. 00 was given to the National Commission for Privatization for Rokel Commercial Bank and was to be repaid in 2015, out of which the sum of USD1, 736,178.63 has been refunded on 29/1/2015, leaving the balance of USD12, 263, 821. 00 which amount has remained unpaid. Those involved in this bridging loan were: i. Dr. Ernest Bai Koroma, former President of Sierra Leone; ii. Dr. Michael Kargbo, former Chairman of the NCP; iii. Dr. Raymand Kargbo, former DG of the Petroleum Directorate; iv. Dr. Kaifela Marah, former Minister of Finance and Economic Development and former Governor of Bank of Sierra Leone; and v. Mr. Momodu L. Kargbo, former Governor of Bank of Sierra Leone and former Minister for Finance and Economic Development. The loan of USD14,000, 000.00 granted to Rokel Commercial Bank was for its recapitalization, and the Government of Sierra Leone which had 51% share in Rokel Commercial Bank before the recapitalization, now has 65.02% of the Shares. The Rokel Commercial Bank is now one of the most successful and profitable Commercial Banks in Sierra Leone. These pieces of evidence remained unchallenged and were mostly unshaken despite the rigorous cross examinations of the witnesses by counsel to the Persons of Interest’.

The excerpt above outlining the two transactions involving transfer of funds from the PD have been partially explained inter-alia.

Hon. Judge, I have highlighted sentences in the above quoted paragraph from your Report to bring out:

- US$3m payment to SMRT for Biometric Registration Kits.

You found out and acknowledged that the sum of US$3m had been paid to SMRT for the Kits. The next obvious logical step was to find out whether SMRT supplied the Kits as per contract specifications and requirements. Thereby satisfying proper use of the paid money. You did not. Instead you created a tendentious situation of the successful completion of the transaction in your write-up thus creating an eerie feeling of a failed contract in which money was lost. To fit into your narrative of Corruption, maladministration, abuse of power and lack of accountability. But was the said US$3m paid to SMRT lost and / or converted for private gain?

- US$12.2M to Bailout Rokel Commercial Bank

1). You acknowledged in your findings that you are aware the money as intended had been deposited with RCB and 2). You wrote glowingly about the positive impact that the intervention in RCB with PD funds has had. This is why it is difficult to understand that immediately after the commendation, your very next paragraph is at complete variance with your previous paragraph on the bottom of page 107 as follows:

‘The evidence disclosed the following Persons of Interest as well as their collaborators as being responsible for these acts of corruption, maladministration, abuse of office and lack of accountability: i. H.E. Dr. Ernest Bai Koroma, former President of Sierra Leone; and ii. Raymond Kargbo, former DG of Petroleum Directorate. Other persons mentioned:

i.Emmanuel Beresford Oshoba Coker, former Secretary to the former President; ii. Karefa Kargbo, former Director of Finance of the Petroleum Directorate; iii. Dr. Kaifala Marah, former Minister of Finance and Economic Development and former Governor of Bank of Sierra Leone; iv. SMRT Co. Ltd; v. Dr. Michael S. Kargbo, former Chairman of National Commission for Privatization; vi. Mr. Momodu L Kargbo, former Governor of the Bank of Sierra Leone and former Minister of Finance and Economic Development; and viii. Guandjin Construction Ltd’.

The two paragraphs back to back don’t speak to each other. They don’t relate. There is no chronology. The above quoted paragraph is as stunning in its conclusions as it is contextually disappointing and confusing in its assertion. Where is the corruption and maladministration and abuse of power and lack of accountability?

Hon Judge, how did you apply the Terms of Reference of the COIs as set out in D 1, 11, 111, 1V, V to reach the finding and conclusions you made?

Corruption is defined by the World Bank as: Abuse of public office for private gain. The Anti-Corruption Act here in Sierra Leone defines Corruption as: Misuse of public power by elected and appointed public officials and civil servants for private gain. Corruption connotes dishonesty and criminal intent. My understanding is that in defining and assessing corruption to determine culpability the following must return positive:

Was there bribery?

Was there conflict of interest?

Was there illegal gratuity?

Was there economic extortion?

Was there economic/financial loss?

I am still wondering how you applied the above being key elements of the Terms of Reference of the COI to reach the conclusion of corruption or rather what other criteria you used to reach your conclusions on the two matters.

Hon. Judge, you indicated in “Methodology” in your Report that one of the reference document in your work was the Sierra Leone Constitution 1991, which states in article 40(1) page 41 that the President is “…the Supreme Executive Authority of the Republic…” This is a designation, the meaning of which you seem not to have countenanced in dealing with the matters.

In the two financial transactions that were inter-agency in nature, the approval of the ex-president was sought as the final head of all the agencies involved. Where is the corruptionin an inter-agency transaction for which His Excellency, the ex-President was the SEA? His Excellency, the ex-President did not want to see RCB, one of the only three locally owned Banks in a banking sector dominated by foreign owned Banks fail under his leadership. This would have brought so much pain and hardship to his citizens, institutions and others and cause considerable economic damage to the country. Similarly, in respect of the Biometric kits, the then pending State Elections slated for 2018 could not be postponed on the grounds of lack of funding. Again, the authority of His Excellency, the ex-President was sought and obtained to move idle funds of Government from PD to cure a problem in other agencies i.e. NEC/NCRS. In both instances, SEA was the enabler to move the funds. SEA of the Republic also means SEA of the Government.

In my days at BSL and MOFED, fiscal prudence and fiscal responsibility dominated all work considerations. Thus in consideration of moneys to be moved from PD in respect of the two transactions, it was made a requirement that the funds drawn from PD must be refunded having served a rainy day very well and the two transfers were treated as loans. Aware of the fact that PD is not mandated to make loans, we resorted to the SEA of His Excellency, the ex-President to plug the gap. You are fully aware that the law in general does not always address all aspects of a situation. When such circumstance arises, the fallback is on an enabler to fix it particularly to make good come real. Whether such fix-it is deemed to be irregular or not, does not necessarily make it illegal and /or corrupt. It is uncontestable fact that the two transactions were fully documented, the paper trail traceable and moneys lodged with the designated parties. These designated parties, RCB and SMRT have gone on to deliver and fulfill expected outcomes.

Hon. Judge, let me now take you through the details of the two transactions for which you have reached a conclusion of corruption, maladministration, abuse of office and lack of accountability.

Rokel Commercial Bank – The US$12.2m Bailout

Immediately I became Governor, BSL in July 2014, I walked into a firing line. I was confounded with the problems of RCB and Sierra Leone Commercial Bank (SLCB) which were on the throes of bankruptcy. Both were national Banks and government was the majority shareholder in RCB and the sole owner of SLCB. The two Banks were also the largest in the country and commanded close to 65% of market share. RCB, formerly Barclays Bank has historical connotations of the glorious bygone years. The Bank engenders substantial confidence among Sierra Leoneans. The two Banks could not be allowed to fail.

Even individually, it was also a case of too big to fail for either of them and disaster loomed for the Government and people of Sierra Leone. The consequence of failure of either Bank was unimaginable. If both Banks had failed all but one of the Banks left operating in the Country would have been foreign owned Banks.

Upon review of both Banks, it became manifestly clear that years of bad lending had resulted in the accumulation of substantial portfolio of non-performing assets which with the passage of time became increasingly toxic. The Banks compounded the problems by cooking the books. They continued to calculate interest income on the non-performing loans; thereby creating a false narrative on paper of a healthy balance sheet while the actual cash flow situation was precipitously deteriorating and losses started to mount. RCB was the most urgent case and required immediate action. The management of the BSL in pursuit of its Bank Supervision Responsibility decided to first rescue RCB. A plan was formulated which was discussed and agreed to with the Ministry of Finance and Economic Development, (MOFED), the National Commission for Privatization (NCP), and State House. The cornerstone of the plan was to invoke article 36 of the Banking Act 2011. This clause in the main empowered the BSL to take over control and management of RCB given it was in a state of crisis, to do any such things to make the bank become once again a viable ongoing financial entity. The center piece of the rescue effort was the infusion of new money which was then estimated at approximately $14m, putting a hold on all new borrowings, beefing up management and cutting expenses.

In such operations, which had never been undertaken before by BSL, the Central Bank would normally provide all the funding to execute the required tasks. Unfortunately, BSL at the time was not well resourced to provide the required funding.

Discussions ensued between MOFED, BSL and NCP with respect to the generation of the funds required for the successful rescue of RCB. The private shareholders of the Bank were engaged but it was determined they were not willing to provide new capital to support the rescue effort. The PD, was identified as the potential source within government’s portfolio to provide the required funding. After engagement with the authorities at PD, agreement was reached with the Governor, BSL, the Minister, MOFED, Chairman, NCP, to provide the required funds on the approval of State House.

A minute was prepared and forwarded to State House, seeking approval to utilize the identified funds with PD on agreed terms to rescue RCB. The minute obtained the required approval from His Excellency, the ex-president, being the SEA of the country at the time but also Minister of Petroleum Directorate. Once approved, the essence of the approved minutes was translated into an agreement to govern the relation of the parties to the arrangement and facilitate the transfer of the agreed funds to RCB.

Upon signature of the agreement, the funds were transferred to RCB. Since the receipt of the funds and accompanied by other supportive measures, RCB has moved from bankruptcy and gone on to become a successful Bank, making profit and paying dividends, meeting its obligations and expanding its reach thus generating more economies The funds infused to RCB continue to work even today.

The fact is though, another option was available to deal with RCB. Do nothing and thereby allow the Bank to go bankrupt. That immediately would have precipitated:

- A run on the Bank with spillover effect (turbulence) on other Banks.

- Depositors denied access to their funds in the Bank.

- Closure of the Bank to the public and reduce market competition.

- Workers would have lost their jobs and gratuities.

- Suppliers and creditors would lose cash payments.

- Government would stop getting tax payments.

The above would have been amongst the first round effect of the bankruptcy and more devastating effects would have followed.

By choosing to rescue the Bank, a potentially damaging situation with serious economic consequences was not only averted but the RCB has experienced a real turn around. It must be recalled here that all the actions of the team I led in this bailout effort was in my official capacity as Governor, BSL. My duties and responsibilities and all other work of the Bank ended on the last day I bided farewell to BSL and walked out of its front door on the 13th day of April, 2016. A key architect of the rescue effort left before the Bank could be nurtured to full health but a very clear pathway had been cut into prosperity. I was no longer responsible for anything connected with the duties and work of the Bank.

SMRT: The US$3m Deposit Payment to SMRT

About mid-July, 2016, after I had been about three months into the new assignment as Minister of Finance and Economic Development, my staff at MOFED alerted me to a very serious negative development in the State Elections Preparation scheduled for March 2018. Authorities at NEC reported that:

1. Computers/ Voters Registration equipment which had been used in the 2012 registration of voters and had been stored away for use in the 2018 elections had become inoperable. That all effort to repair them had been unsuccessful. New computers/Registration equipment were required urgently as the registration period was fast approaching.

2. Worse still was the fact that no provision had been made in the election budget to procure new equipment. The budget itself even before this new development already faced threats of overruns.

A real emergency was on my hands. An alarm bell also rang to the effect that the quantity of equipment required was substantial and the type cannot be picked off the counter shelf in stores. The parts of the equipment needed to be procured, assembled and configured to specific needs and requirements. Meaning that sufficient lead time was necessary when placing an order to meet the targeted time.

The first recourse was to turn to our international partners for help and support. MOFED approached both the UNDP and World Bank Country Office for assistance to provide the required equipment. The effort proved futile.

Pressure was beginning to mount on MOFED to provide resources to procure the required equipment. That was the only option available. Postponing the then pending elections for lack of funds would have incurred substantial backlash from the voting public. A solution was needed and fast. In conversation with the then Minister of Internal Affairs (MI) whose mandate covered both the National Elections and Civil Registration, he reiterated that the National Civil Registration was to commence in 2017. Given the similarity in the activities as well as the timing of the implementation, it was decided to explore ways to link the execution of both activities with a view to saving time and cost to realize internal economies.

Staff of MOFED, MI, NEC and NCRS soon formulated a plan that allowed NEC to take the lead in the registration process to register the population in the age category of seventeen (17) years and older. The database generated would be shared with NCRS who would thereafter receive the Biometric Registration Kits and go on to register all population categories in the country. Money was identified in the NCRS budget, although not near to match what was required to procure the equipment. But at least it can be said that seed money was available for work to start.

The acquisition of the Biometric Registration Kits was identified as singularly the most important activity to be undertaken for the main work to start and this was time bound. The NCRS was authorized to undertake the procurement of the Kits who quickly launched an International Tender for the acquisition of the equipment. MOFED concentrated on sourcing funds to meet the overall cost of the procurement which was estimated at about US$12m.

SMRT of Belgium emerged the winner of the International Tender for a contract price of US$13m for the supply of the following:

Registrations units including spares 3800 units

Solar panels kits including spares 3800 units

Software customization 1 unit

Central site software 1 unit

Operation and Technical Support 1 unit

Software and hardware for AFIS 1 unit

Hardware for Districts 14 units

During the negotiations with the contractor leading to the signing of the contract, SMRT made an urgent plea for immediate advance of US$3m to fast tract the work by making deposits with the parts suppliers in Europe. This had been anticipated and arrangements had been underway between MOFED, MI, NCRS, State House and PD who had agreed to provide funding as loan to MOFED to urgently provide the required amount.

Approval was sought and obtained from His Excellency, the ex-President in his capacity as SEA of Government to utilize the funds. This was Government using its money held by one agency to solve a problem in another agency with His Excellency, the ex-President as key facilitator of the transaction.

The US$3m paid to SMRT was not a loan from PD as erroneously stated in the White Paper page 22, paragraph 1. The US$3m in question was a loan to MOFED. Given it was MOFED that was charged to make provision for the procurement of the required equipment. That the amount of the loan was paid directly to SMRT was an operational matter given that all arrangements had been finalized and contracts signed. At the time speed was of essence.

SMRT supplied the Kits which arrived in time and quickly deployed in the registration of voters for the 2018 National Elections. The process went very well from the point of view of voter registration. At the end of NEC’s work, the kits were transferred to NCRS as owners and can be found in all Districts of the country. In effect, the US$3m had provided utility to NEC (Government) who conducted the 2018 National Election without a hitch and the kits are now with NCRS (Government) who continue to obtain utility from them.

How then can you order a refund to Government of the money used to procure the equipment?

Another option available then was to have gone to the Treasury Bills Market and borrow the required amount and in the process increase the National Debt to be paid under pressure at an interest rate of approximately 18% pa. Fiscal Prudence which was my primary responsibility as MOFED would not consider such option as opportune given other alternatives. An aspect of government is continuity from one government to the other. On the 4th of April 2018, a new President was sworn into office and I ceased being MOFED. Given that all my actions while in office were under the guise of the Minister, I no longer carry that mantle. I therefore cannot be held responsible and punished for matter arising after I had left office.

Hon. Judge, I believe that through the above narrative arising out of the two financial transactions I became involved in relation to PD, I have proved without any doubt that the moneys in question are in cash and materials with Government from which it continues to derive benefits and utility. The moneys have become fungus but are directly traceable to the beneficiaries. Yet, you choose to order that I and my collaborators pay back into Government the said moneys.

This is bullying. Yes, bullying me. You took advantage of your privileged and exalted position to make coercive demands on me.

In economics there is the concept of Pareto Optimality, which is that you should not better yourself at my expense. In ordering that I refund moneys to the Government which it already has and from which benefits and utility are being continually derived, you are bettering Government at my expense. Inside out, your findings, orders and punishment don’t make sense at all. The two moneys of the transactions are at work for Government. What is the restitution for? There was:

No Political loss

No Social loss

No Economic/Financial loss and

No loss even by you.

Irrespective of the no losses, you still imagined acts of corruption, maladministration, abuse of office and lack of accountability.

Based on the above, I submit to you that no prima farcie case of corruption was proven against me and even without me defending myself in your COI, the facts available to you, when considered objectively and with a clear mind and conscience would not allow you to make the findings and conclusions you reached and therefore punishment meted out to me. Neither intent/motive to corrupt was established nor were any provisions in the Sierra Leone Constitution 1991, the Public Financial Management Act 2016 and its rules and regulations cited as having been violated in respect of the transactions.

If it became desperate that the US12.2m must be refunded to the state, was it not much more proper, logical and rational that your order should have been to sell the additional RCB shares acquired by the Government and transfer the proceeds of the sale to the Treasury!!

Did you not see a game plan being carefully orchestrated to provide just minimum information on the Biometric Registration kits. But again, once it was established in your COI, that the US$3m had been paid to SMRT for supply of the Biometric Registration Kits, did curiosity not lead you to inquire whether the equipment were supplied in the right quantities and specifications? This was to ensure value for money. NEC and NCRS who were key players and beneficiaries of the equipment were never brought by the State as witnesses for obvious reasons. Do you now see a game?

This matter of information manipulation brings me to another issue of inaccuracies in your Chapter 9 dealing with my transactions with PD. In the nine page write-up are errors the most obvious being in page 106, starting sentence on line 10 that “…The Public Service Commission has the mandate to appoint, promote, confirm appointment on promotion, dismiss and discipline public officials…”

The above is manifestly wrong. In Sierra Leone, the Public Service Commission in the main is the Recruitment Agency for the Civil Service. The Human Resources Management Office performs the functions quoted above from your Report. Further, almost all agencies in the Public Sector are established by acts of parliament which empower each to have independent Human Resource Management Administration. The point is that these types of misunderstandings cloud analysis and evaluation of information/evidence and leads to wrong conclusions. If two to three errors can be found in a nine page chapter, one wonders how many more are present in a 185 page document. The threat is real and a peril to all those you have found guilty and recommended for punishment.

Hon. Judge, you were recruited and given a pricey salary, very well provided for and protected, all paid with tax payers Leones and part of, expensively converted to US dollars to undertake corruption investigation here. You were expected to find out and state: The truth. The Whole truth. And nothing but the truth. This was to produce outcomes which the vast majority of the country would embrace and rally around in the fight against corruption. And in the process deepen the Peace Dividend arising out of the 2018 Presidential election which the opposition won resulting in peaceful transfer of power.

You did not find out and state the truth. The whole truth. And nothing but the truth. Instead, my case as example, transactions undertaken consciously with good intentions and resulting in the most desired outcomes like the GTT report were twisted and criminalized to feed the narrative of corruption. Your Report therefore instead of calming and rallying society against corruption has created more polarization, animosity and resentment leading to the questioning of the objective, validity and intent of the COis.

This is sad—really sad.

I here rest my case.

Momodu L. Kargbo

Former Governor, BSL

Former Minister of Finance and Economic Development, MOFED

Cc:

The Nigerian High Commissioner

The Ghanaian High Commissioner

The British High Commissioner

The SG, MRU

The Ambassador, USA

The Ambassador, EU

The IMF Resident Rep.

The World Bank Country Rep.

The AfDB Country Rep.

The UNDP Resident Coordinator