Breaking News: 12th August 2021

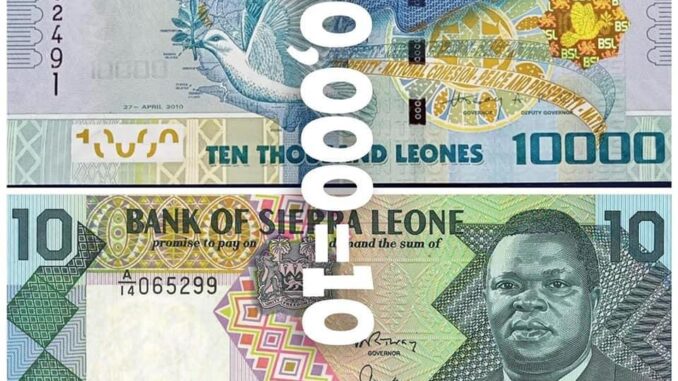

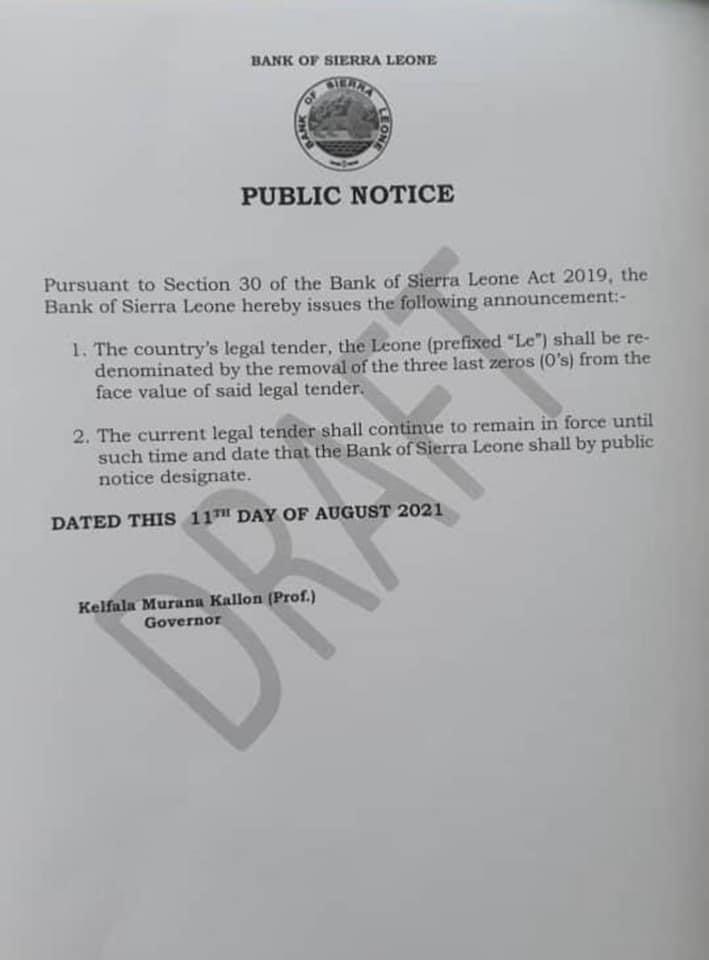

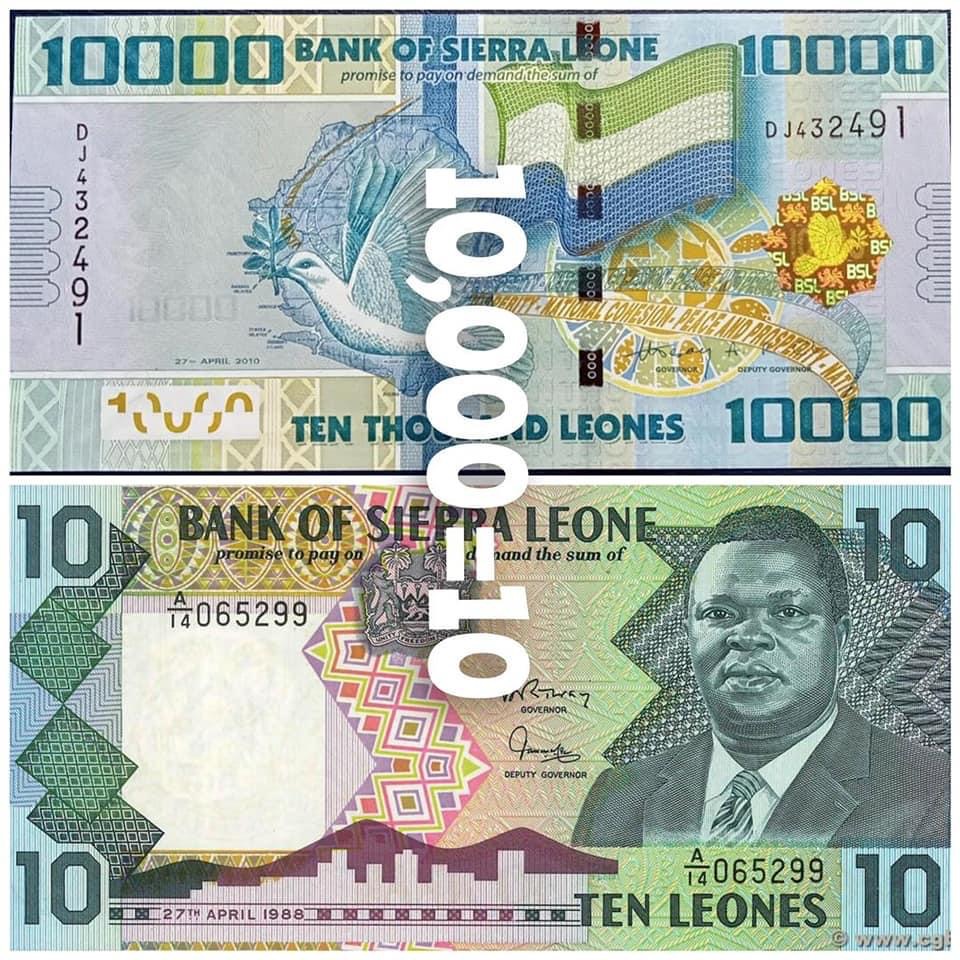

Bank of Sierra Leone Removes 3 Digits from the Leone

The measure is normally taken by Central Banks in countries facing hyper inflation and a general devaluation of the national currency.

The measure entails removing three digits and eliminating calculations in thousands and millions in the exchange rate.

After the elimination of the 3 digits, the exchange rate of the Leone to the dollar will be Le 10.00 to the dollar instead of Le 10.000.00.

The elimination of the three digits has some advantages though in reality, it will neither affect the value of the Leone nor the exchange rate.

The most significant advantage will be portability! It will now be possible to carry larger amounts of money to transact business. The equivalent of $1000.00 dollars can be carried in one pockets in Leones. Unlike in the current situation, the equivalent of USD 1000.00 which is Le 10 million can only be transported in a wilbarrow!

However, the standards of living of the people will not improve in terms of salaries, prices of goods and services. A teacher who receives a monthly payment equivalent to $200.00 will receive the same amount of money in the new local currency. This means that the teachers purchasing power will neither increase nor decrease. The only change he will experience is the capacity to carry his entire salary in his wallet without anyone knowing he has been paid.

This is a giant’s step taken in the right direction by the Government.

I was born without a hornback but the carrying of my portfolio loaded with Leones has created a hornback throughout my back!

The new notes are meant to abolish the creation of fake millionaires and the bogus talk about millions and millions of Leones.

Idrissa Salaam Conteh

Cecil Pratt

Sierra Leone 🇸🇱 government is proposing to redecimalise or what they called ‘redenominated’ its currency by removing three (3) zeros from the Leone(Le).

As usual in Africa, politicians/government officials attempting to use cosmetic and over simplistic approach to solve bread & butter issues in a deceptive manner.

Sierra Leone is not producing anything, the country Economy is import base 🙄. Redenomination will cause inflation, because importers and traders will reprice their goods and products upwards. Increase inflation will increase interest rate. There will be more demand for foreign currency and this will further weakening the Leones against the US dollar $ and pound sterling £.

I appreciate the concerns and frustration coming from the bank governor; because people and businesses are holding to huge amounts of Leones (Le), while others are taking money (capital and investment) out of the country. The Bank governor want people and businesses to use the banking system.

In the short term, I believe the bank governor will succeed in getting people to use the banking system as a result of this “redenomination approach”. People and businesses will put and pull their money from the banking system. Hence, the benefits will be shortlived, medium to long term, it will be detrimental to the country Economy and create more hardship for the people.

The central bank and governor is ignoring some major drawbacks with Sierra Leone Economy, like the economy is not producing anything, economy not exporting much, corruption is rampant and the government taxes and wage bill is excessive. Government and the central bank policies should try and address this drawbacks. I don’t believe that redenomination of the currency (Le) will solve anything. As stated earlier, the people will continue to struggle to find ‘bread and butter’ to survive.

Just my opinion 🤷

A Sierra Leonean Top Economist in Australia Mohamed Bangura explain the re-denomination of our currency.

It’s a good move brother. It’ll help to stabilize the economy, provided appropriate monetary and fiscal policies are in place.

I have long suggested this, but sometimes, people in power doesn’t listen to outsiders. With so many zeros on a small tender, this was partly the reason why inflation was difficult to control.

I hope the government (and country) succeeds in this 👏👏👏

After the implementation of this denomination, I suggest the economists of Bank of Sierra Leone to create an inflation target. This inflation target will help the Bank to take appropriate economic actions and is also a better way to maintain price stability – which decides the bread and butter of any country.

There are lots of good things associated with this currency re-denomination.

That is to say the above implementation will only work with an “effective inflation target” system, together with price stability.

Firstly, the country is economically unstable with imports outstripping exports. The reason for this is driven by the domestic hyperinflation rates, rendering the Leones useless in the international market.

Because of domestic hyperinflation, the currency is unable to compete on equal terms with other currencies. Therefore, our businesses are forced to either adopt a foreign currency (mostly, the US dollar as it is a vehicle currency), or hedge the Leones to other stable or low-inflation currencies.

With respect to the current decision of Bank of Sierra Leone, revaluing or denominating the currency will automatically restore consumer confidence in the short run. Through consumer confidence, businesses can boom and become competitive in the international market. Once this occurs, Sierra Leone’s Balance of Payments (BoP) will move to positive directions as exports will be greater than imports.

However, the above implementation will only be sustainable in the medium to long run if the Central Bank concurrently purses an “inflation target” in order to keep inflation under check. So long as inflation is under control, price stability will be achieved which would lead to increased economic activities, and hence achieve higher exports.

Yankuba Kai – Samba

FOCUS ON SIERRA LEONE: 12 August 2021.

The decision by the governor of the Bank of Sierra Leone to redenominate the Leone confirmed what I have been saying that the Leone has become worthless and nontransacditional outside the shore of Sierra Leone.

This move by the central Bank is also a recognition that the

economy of Sierra Leone suffers from persistently high inflation, thereby reducing the Leone to being one of the weakest currencies in the entire world.

So what impact will the redenomination of the Leone have on the foreign exchange, when the new change in the Leone is triggered.

Basically, it is symbolic as it does not have any impact on a country’s exchange rate in relation to other currencies. However, it has a psychological impact on the consumer population by given the appearance that a period of high inflation is over. Where I used to buy a bottle of water for 5,000 leones, I will now pay 5 Leones. Personally I would consider redenomination as a convenient deception in reducing inflation.

But it also give us an indication that Sierra Leone is preparing to join the one regional currency call ECO.

My thoughts.

Yankuba Kai-Samba