|

By State House Communications Team

President Dr Ernest Bai Koroma officially opened the newly constructed branch of the Union Trust Bank in Lunsar, Port Loko District last Friday.

Delivering the keynote address shortly before cutting the tape to mark the official opening of the branch, President Koroma said that the private sector is at the heart of the economic transformation of Sierra Leone. He noted that Lunsar is not just one of the fastest growing towns in the country, but also a practical demonstration of government’s commitment to put the private sector at the centre of the development process. “My government has facilitated the investment of hundreds of millions of dollars in Lunsar and its environs, and today we are here to witness the launch of another private sector activity that is at the heart of the economic transformation of our country”, he said amidst rapturous applause.

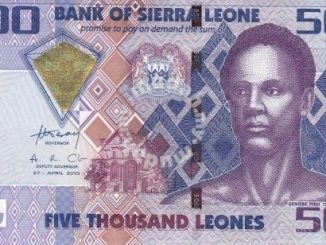

President Koroma emphasized that government has improve trade and doing business environment in Sierra Leone since he assumed office in 2007, adding that incentives like bank loans, stable macroeconomic environment that is needed for business to flourish, including a stable exchange rate, declining interest rates as well as declining inflation that is now single digit have been provided to improve on the system. The opening of the UTB branch in Lunsar, according to President Koroma, is in line with government’s policy to improve access to finance for the people and communities, saying that UTB is the biggest privately owned indigenous bank in the country. “If anybody is in doubt about the ability of Sierra Leoneans to be at the forefront of their own transformation, the UTB should restore their trust”, the president said.

President Koroma however urged citizens to respect the contracts with banking institutions and pay back their loans, as the culture of non-repayment of loans in Sierra Leone must stop. “If a bank collapses due to non-repayment of loans, the Government may be responsible to pay back depositors’ money using tax payers’ funds. This is the reason why the Central Bank has been very tough on customers with bad loans”, he stated. The Head of State further maintained that government has designed the Local Content Policy because of the need to empower Sierra Leoneans who are ready to be part of every level of the economy. “From transportation to logistics to mining engineering and top management, there are Sierra Leoneans who can do it, and there are many more who, when given the opportunity can acquire the skills and experiences necessary for effective involvement in the economic transformation of this country”, he said, and quickly disclosed that he had instructed ministers and other government officials to ensure that the local content policy is robustly implemented. “We demand that all companies respect this aspiration of Sierra Leoneans to be integral players in the economic transformation of their country”.

Tapsiru L. Dainkeh, Director of Banking Supervision Department, Bank of Sierra Leone, who represented the Governor of Bank of Sierra Leone, revealed that the opening of the eleventh (11th) branch in Lunsar is a clear manifestation of the bank’s strategy towards the grassroots communities in the country. He also noted that there are currently thirteen (13) commercial banks in the country and eighty-eight (88) branches nationwide, of which Union Trust Bank has eleven inclusive of this new Lunsar branch (about 11.3% of the total branch network). The Director of Banking Supervision further disclosed that the Sierra Leone economy is predominantly cash-based and a significant proportion of economic activities occur in the informal sector. “Only about 14% of the bankable population has active accounts and undertakes financial transactions through the banking sector”, he said, adding that the opening of the Lunsar branch will provide opportunity for the people of the community and its environs to benefit from banking services. One of the major weaknesses of the financial sector, according to Mr. Dainkeh, is poor access to credit and other financial services by enterprises and households in the rural areas and less privileged communities. The rural communities are largely financially excluded. In his welcome address, P.C. Bai Koblo Queen the 2nd said the opening of the bank fulfills a long and burning aspiration of the people of Lunsar to have a major financial institution that will empower them to access affordable financial services and products that will render them capable to match the resource potential of the community.

Chairman of the Board of Directors of UTB, Ambassador Umaru B. Wurie called on government to consider the possibility of providing fiscal incentives for those banks that invest their resources in promoting rural financial intermediation, in broadening the financial services across the country, and in supporting the national agenda for Prosperity. By way of closing remarks, Founder and Chief Executive Officer of UTB, James Sanpha Koroma said, the opening of the Lunsar branch opens a window of opportunity to the local community to improve their life styles by engaging in viable and gainful business enterprises; to better explore and access the opportunities provided by the resurgence of mining activities in the community. He also maintained that “We built this new building to send a clear message that we want to be an integral part of this community, and we are here to stay.” |

Leave a Reply